Should I Close My Help To Buy ISA?

Almost 800,000 first-time buyers have used a Help to Buy ISA to buy a home, but over the last few years, many savers have decided to switch these accounts over to newer alternatives, like a Lifetime ISA. If you’re wondering if you should close your Help to Buy ISA or keep paying into it, here’s what you need to know.

Why are people closing their Help to Buy ISAs?

When Help to Buy ISAs were first introduced in 2015, they were the first of their kind - a specialist ISA account that lets you save up to £200 a month towards your first home and the government would boost your savings by 25%. Two years later the government introduced the Lifetime ISA (LISA), which also gives you a 25% bonus. In November 2019, banks stopped offering Help to Buy ISAs to new customers, which means if you haven’t got a Help to Buy ISA already, you can no longer open one. Instead, consider opening a Lifetime ISA as an alternative way to save up your first house deposit.

With a Lifetime ISA, you can save up to £4,000 each tax year towards your first house deposit, or retirement. Like a Help to Buy ISA, the government will top up your contributions by 25% for free, up to £1,000 each tax year. That means you can save £1,600 more into a Lifetime ISA each tax year than a Help to Buy ISA, and get up to £400 more for free from the government.

If you have a Help to Buy ISA already, you can keep paying into it until the 30th November 2029, and you’ll have to use the funds to buy your first home by the 30th November 2030. If you want to keep saving longer than this, consider moving your Help to Buy ISA funds to a different account, like a Lifetime ISA. If you don’t move your funds before the 2030 deadline, you can withdraw your savings and any interest you’ve earned penalty-free, but you won’t be able to claim the 25% bonus.

Learn more: Is a Lifetime ISA a Cash ISA?

Save with the marketing-leading LISA

Open a Tembo Cash Lifetime ISA to benefit from our market-leading {{LISA_RATE_AER}}% AER (variable) rate. That’s hundreds more towards your first home or retirement over 5-years vs the closest market competitor!

When considering opening a LISA, remember that withdrawals for any purpose other than buying a first home or for retirement will incur a 25% government penalty, meaning you may get back less than you paid in.

Is a Lifetime ISA better than a Help to Buy ISA?

For some people, a Lifetime ISA is far better than the Help to Buy ISA, but it won’t be right for everyone. A Help to Buy ISA is best for those who need easy access to their savings and the freedom to spend their money on anything they wish, for example. Whereas you’ll pay a 25% withdrawal penalty if you take money out of your LISA for anything other than your first home or retirement.

But if you want those funds to be for your first home and nothing else, a Lifetime ISA is a great way to build up a house deposit while benefitting from a free 25% boost from the government.

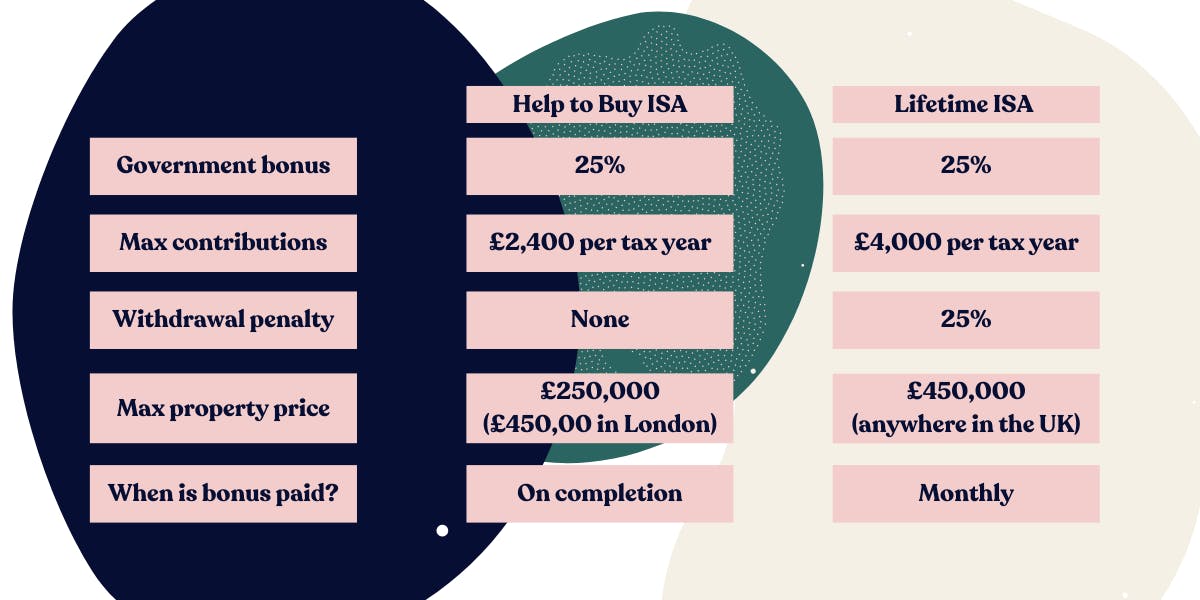

Let’s compare the two options side by side.

When should I close my Help to Buy ISA?

You may decide to close your Help to Buy ISA if your plans change, you’d like to save more than £2,400 a year or you’d like to buy a property that doesn’t meet the Help to Buy ISA criteria, for example, a home that costs over £250,000 (or over £450,000 in London)

Here are some of the most common reasons you might close your Help to Buy ISA.

1. You’re buying a home worth more than £250,000 (or £450,000 in London)

You can use the money in your Help to Buy ISA to buy any property, but you’ll only get the 25% bonus if you’re buying a home worth less than £450,000 in London or less than £250,000 everywhere else.

If you’re buying a property in London for more than £450,000, it may be a good idea to close your Help to Buy ISA and move your money over to a Cash ISA with a better interest rate. You’ll still miss out on the 25% bonus, but at least you’ll earn more interest on your savings!

If the property you’d like to buy is outside of London, consider a Lifetime ISA. You can use a Lifetime ISA to buy a property worth up to £450,000 across the whole of the UK, but you’ll need to have your LISA for at least a year before you can withdraw the money for your first home.

Learn more: When is the Lifetime ISA bonus paid?

2. You can save more than £2,400 a year

If you’re able to save more than the £200 a month Help to Buy ISA limit, you’ll need to find another home for the rest of your savings. You could place additional savings in a Cash ISA, for example. You’ll continue to earn tax-free interest, but you won’t get the 25% government bonus like you would with the Help to Buy ISA.

Another option is a Lifetime ISA. You can save up to £4,000 each tax year, you’ll earn tax-free interest and the 25% government bonus - up to £1,000 each tax year. There’s no monthly limit either, so you could place the full £4,000 in your LISA in month one or make regular contributions throughout the year.

However, unlike Help to Buy ISAs and Cash ISAs, remember that you’ll pay a withdrawal penalty if you take money out of your Lifetime ISA for anything other than your first home or funding retirement. You can only use a Help to Buy ISA or a Lifetime ISA to purchase your first home - not both. So, if you want flexibility, it might be best to keep your Help to Buy ISA and open a Cash ISA instead of a LISA.

Perfect for you: Cash ISA or Lifetime ISA. Which one should I pick?

3. You want to save for retirement at the same time

Some people switch from the Help to Buy ISA to the Lifetime ISA so they can save for their first home and retirement all in one place, but you don’t need to choose one or the other. You can have both, as long as you only use the bonus from one of them for your first home. So you could use the Help to Buy ISA for your first home and your LISA for retirement.

Keep in mind that pensions such as workplace schemes are usually better than Lifetime ISAs for saving for retirement. You’ll earn tax relief on your pension contributions, which works out the same as the LISA bonus if you’re a basic-rate taxpayer. If you’re a higher or additional rate taxpayer, you’ll earn tax relief at 40% or 45% respectively, which beats the 25% LISA bonus by miles. And, if you’re eligible for a workplace pension, your employer will pay at least 3% of your salary into your pension pot.

Learn more: Is a Lifetime ISA worth it?

By saving into a Lifetime ISA instead of enrolling in or contributing to a pension, you may lose out on contributions by an employer (if any), and it may affect your entitlement to means-tested benefits.

When should I keep my Help to Buy ISA?

Here are a few situations where it may make sense to keep your Help to Buy ISA open. For example, if you’ve already built up a decent house deposit and you want to buy a house soon. The last date you can pay into a Help to Buy ISA is November 2029 and the last date you can claim the bonus is November 2030. So if you think there’s a chance you’ll need to buy after that, consider switching to a Lifetime ISA instead. If you want the flexibility to use your funds for something other than your first home or retirement, consider a Cash ISA instead.

Can I transfer my Help to Buy ISA to a Lifetime ISA?

You can withdraw the money from your Help to Buy ISA and place it in a Lifetime ISA instead, but remember that you can only deposit up to £4,000 into a LISA each year. So you’ll need to wait until the following tax year(s) to transfer more.

You can set up a Lifetime ISA by choosing a provider and signing up online or via an app. You can open a Tembo Lifetime ISA in just 5 minutes by downloading our award-winning app and opening an account.

Once we’ve received your deposit request, the money from your Help to Buy ISA should land in your account the following day, but it can take up to 3 working days if you transfer the funds via direct debit.

Read more in our How to transfer a Help to Buy ISA to a Lifetime ISA guide

Join the 350,000 others already saving

Start saving towards your next life milestone with Tembo, whether that’s a house, a wedding, a holiday or that all-important emergency fund. Download our award-winning savings app to get started.