Increase the amount you can borrow with an Income Boost

An Income Boost mortgage, also known as Joint Borrower Sole Proprietor (JBSP) mortgage is a way of adding some or all of a family member or friend's income to a mortgage to increase the buyer's max borrowing.

How a Tembo Income Boost works

So you need to close the affordability gap

You’ve got a healthy enough deposit saved, but you can’t borrow enough to buy your dream home. It’s an all too common story.

Affordability gap

Max borrowing alone

Deposit

Time to tag in a booster

With an Income Boost, an eligible booster can add some of their income to your mortgage to fill the affordability gap. They will have no ownership over the property, but will need to help with repayments if required.

You’re all set to get that dream home

With your booster onboard and the affordability gap gone, we’ll scan the whole market to broker you a Joint Borrower Sole Proprietor (JBSP) mortgage with the additional income.

Check if you're eligible for an Income Boost

Get started

Income Boost Calculator

See how much you increase your borrowing by adding an Income Boost to your mortgage.

Lenders will currently let buyers borrow around 4.5x income, and average house prices sit at 7.5x income.

Budget with Booster

£247,500

£720 per month

Budget on your own

£135,000

The benefits of using an Income Boost

Buy the home you really love

By combining up to four income sources, an Income Boost can significantly increase a buyer's borrowing potential. So there's no need to compromise on your dream home or your dream location.

A stepping stone to doing it alone

An Income Boost is a temporary support for buyers as they are getting onto the property ladder. When your circumstances change (i.e you get a pay rise), the Booster can come off the mortgage!

Your family won't be out of pocket

With an Income Boost there's no need for a Booster to dip into cash savings or investments to help their buyer. They won't be on the deeds of the property, meaning there's no stamp duty liability.

Risks & considerations

As with all loans and mortgages, it's important to understand the potential risks and eligibility criteria when considering using an Income Boost, known as a Joint Borrower Sole Proprietor mortgage.

Things to consider...

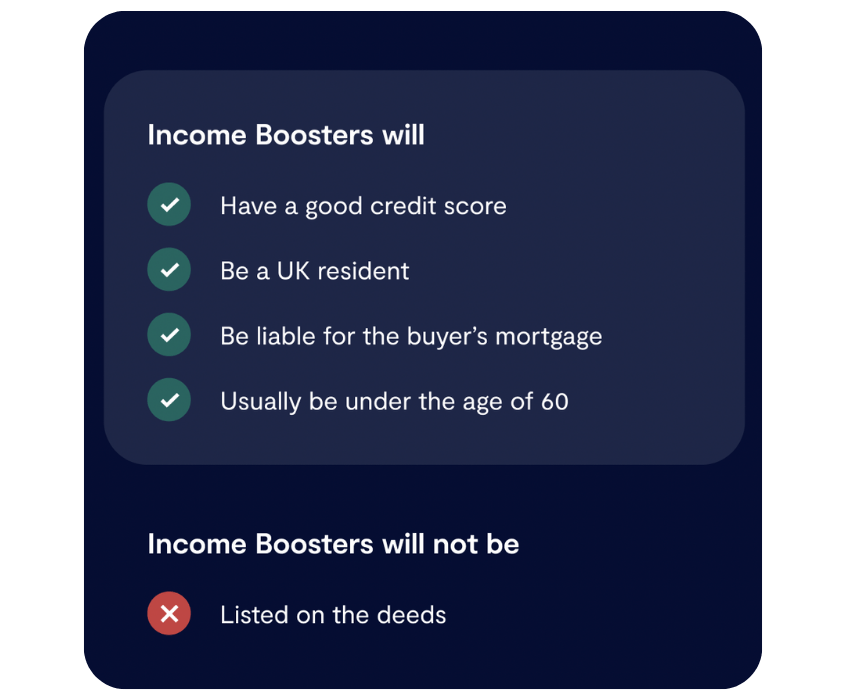

The Booster and the buyer will have to pass a credit check

All borrowers on the mortgage application will need to pass a credit check. If the Booster is overcommitted with their borrowing and outgoings (for example, the Booster’s own mortgage is too big), they may not be eligible for a JBSP mortgage.

Everyone on the mortgage is jointly liable for the monthly payments

It is important to note that all those named on a JBSP mortgage application are ‘jointly & severally liable’ for the monthly mortgage payments. If no one makes those payments, this will affect the credit history of all those named on the mortgage application.

The Booster will not have any legal rights to the property

All those named on the mortgage application will be liable for repaying the mortgage. However, only the homeowner has any rights to the value in the property. So parents or relatives who put their income at risk in this way will have no rights to the property.

Why Tembo?

We're making it possible for you to buy a home.

Interest rates start from 2.5%

Sourced 22nd June 2022. We work from a comprehensive panel of lenders that are representative of the whole of the market. This could get you the best interest rate going on your mortgage.

Secure and trusted

Tembo is authorised and regulated by the FCA. Plus, we're backed with investment from leading names in finance including Aviva.

First-time buyer specialists

Our qualified mortgage experts are trained to make your homeownership dreams happen. In fact, over 70% of our users couldn't buy their home without using a family Boost.

How an Income Boost works

See how an Income Boost could help you increase your affordability

Thousands of buyers have used Tembo to discover how a family Boost could make their next move happen.

Read our reviews to find out why our customers rate us as 'Excellent' on Trustpilot.

View TestimonialsHungry for more information?

A Boost is a way for family or friends to help you get on the ladder. If you need help explaining Tembo to your loved ones, download our handy guide. Or, if you'd like to see the proof behind the claims we've made here, check out our transparency page.